Your step by step guide to becoming a first home buyer.

Buying your first home is exciting, but can be daunting and confusing. Don't worry! We've cut through the noise to give you a clear, simple breakdown of the key steps, and government schemes to help you get onto the property ladder sooner.

THE LADDER STRATEGY:

Become a first home buyer by leveraging multiple government schemes - Entry is easier than ever, you can buy now with just 5% a deposit needed.

Know exactly you can afford - no guesswork, find your real borrowing capacity and get pre-approved.

Make sure you’re prepared to act - get your approvals, build your deposit and do your research so you can act with confidence

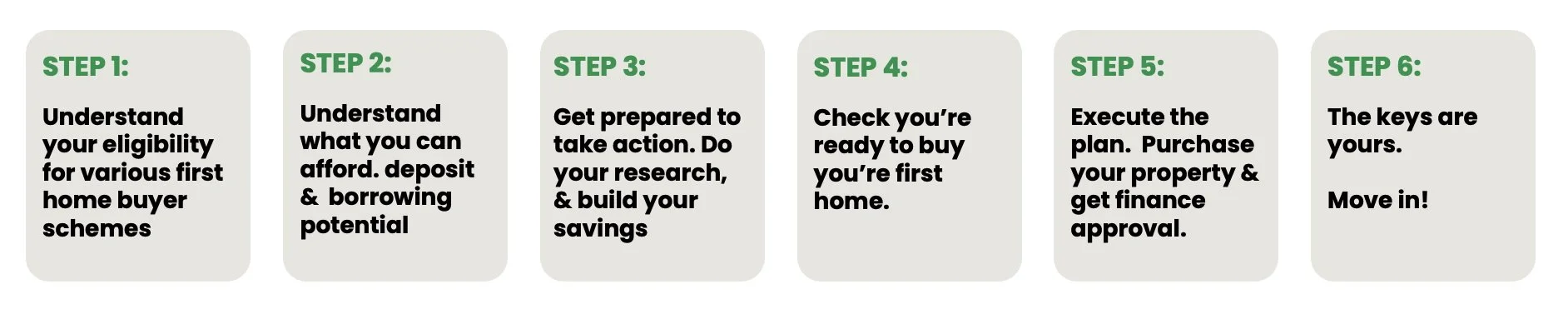

Your 6 step plan to buying your first home

STEP 1: Understand your eligibility for various first home buyer schemes

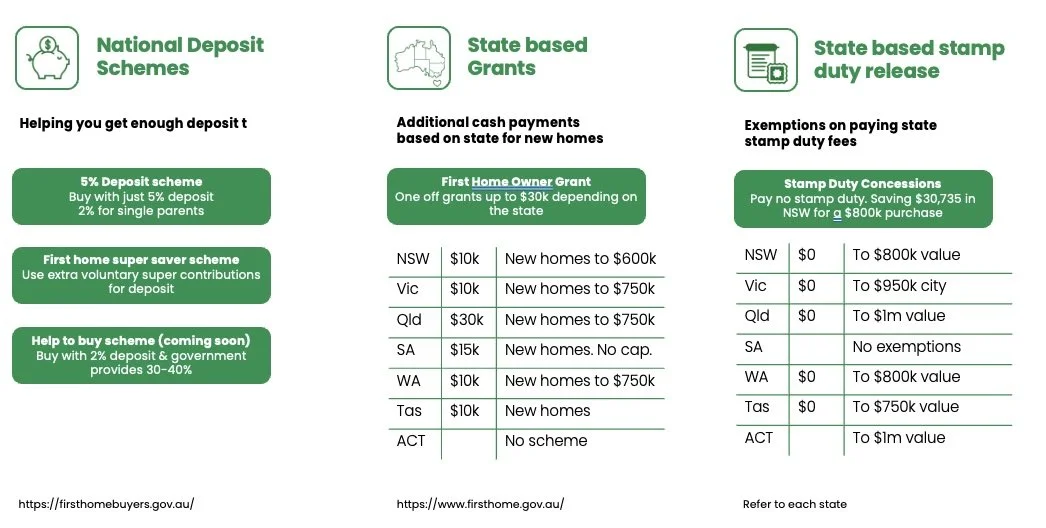

The headline here is the government’s new 5% deposit scheme, but actually there are actually many different schemes available, and many variances by state. The table below outlines the main schemes.

The first step is to understand what you’re eligible for. There are some income and property price caps so speak to us, or start researching. It can be confusing, so we’re happy to help guide you through the schemes, and check your eligibility.

The good news is that you can stack some of the different schemes on top of each other. This provides a great incentive to get into the market.

Note: Specific eligibility rules apply and there are many variations e.g. higher caps for regional areas

STEP 2: Know your borrowing power (the real number)

The single most important step after checking eligibility is knowing your true borrowing ceiling. This it’s a critical piece of strategy.

Calculate Your Capacity: Your borrowing capacity is the maximum amount a lender will realistically give you. It’s calculated based on your income, expenses, and debts. Knowing this number gives you a non-negotiable budget and stops you wasting time on properties out of your reach.

Secure Pre-Approval: Getting pre-approval confirms your borrowing capacity so you can bid confidently at auctions up to your limit.

Strategise Your Deposit: Beyond the schemes, you’ll also need a plan to reach you deposit amount. The new 5% deposit scheme means you’ll only need a $25k deposit for a $500k property. So the entry point is getting easier for for first home buyers. However this benefit is balanced out by the fact you’ll have to borrow the other 95%.

How much have you saved? Do you have an efficient savings plan?

STEP 3: Be prepared to take action

Now you’re ready to enter the market. It’s important to do your research on the type of area and property you want to buy,, and what costs of owning a home are.

Mastering Market Selection: To move up the ladder later, your first property needs to be a good investment & right for you.

Buy Smart: Research areas with future infrastructure investment, good transport links, and desirable amenities.

Find your ‘comfortable’: Find an area or property you’re comfortable to live in. You may need to change your location from renting so think about what you’ll be happy with. Don’t forget, it’s not your forever home, so be happy to make a few compromises.

Hold for Growth: Real estate is a long-term asset. Holding onto the property for several years, allows the equity to build, which then becomes your deposit for your second, bigger home.

Property Type: Think about whether you’re buying a new build (to get the FHOG) or an established home or unit? This decision must align with your budget and long-term goals. Some new builds especially apartments carry some risks.

Understand your ongoing costs: Prior to purchase, we’ll provide you with clear information on what your mortgage repayments might be, so you can budget appropriately

Build a buffer: Beyond the mortgage, ensure you have an adequate buffer of savings for ongoing costs like council rates, insurance, and maintenance.

Get pre-approval: This final step tells you how much the bank will lend you, so you can bid with confidence knowing your limits

STEP 4: Check you’re ready to be a first home buyer

We all know renting can be a nightmare, and many first home buyers can’t wait to have their own place. Having done the steps above, the next question you should ask yourself is - Are you ready to be a homeowner?

Buying a home comes with responsibility, so make sure you’re committed to buying and holding your property.

STEP 5: Execute the deal

Crunch time. You’ve done all the preparation, now you’ll need to buy your property. Bidding at auctions can be an adrenalin rush. But if you’ve done the groundwork, know your market and budget, this final stage becomes easier.

We’ll also help you get your finance application ready, guiding you through the process step by step.

STEP 6: Move in!

Success! There’s nothing like the excitement of buying and moving into your new home. There’s a world of possibilities ahead - whether deciding on what colour you’ll paint the house, which succulents for the balcony, or finally being allowed to get a dog.

Ready to make the step up?

The first easy step is simple: Have a conversation and know your borrowing capacity. Everything else flows from that number. We will help you calculate your full potential, combine the right schemes, and set you on a path to not just own a home, but to build real wealth.

Call Will on 0414 877 724 or will@ladderfs.com.au and he’s happy to help guide you through the whole process.