The spring property market is hotting up once again.

As the weather warms up, so does the Australian property market. The start of spring has brought a fresh burst of energy, with recent data from the Cotality Home Value Index (HVI) showing the strongest monthly rise in national dwelling values since October 2023. This is great news for homeowners and an important signal for anyone looking to get into the market.

OVERVIEW

The property market is gaining pace - September 2025 was the highest growth in 2 years.

New opportunities for first home buyers to enter the market - 5% Deposit scheme just launched

Not all regions growing same - know your market before you buy

What’s driving the property growth?

The key trend is a significant "supply squeeze." Across the country, the number of properties for sale is at a historic low. This scarcity is pushing up prices and creating strong competition among buyers. In cities like Perth and Brisbane, for example, listings are well below their long-term average, which is helping to fuel rapid value gains.

Growth at different rates across the country

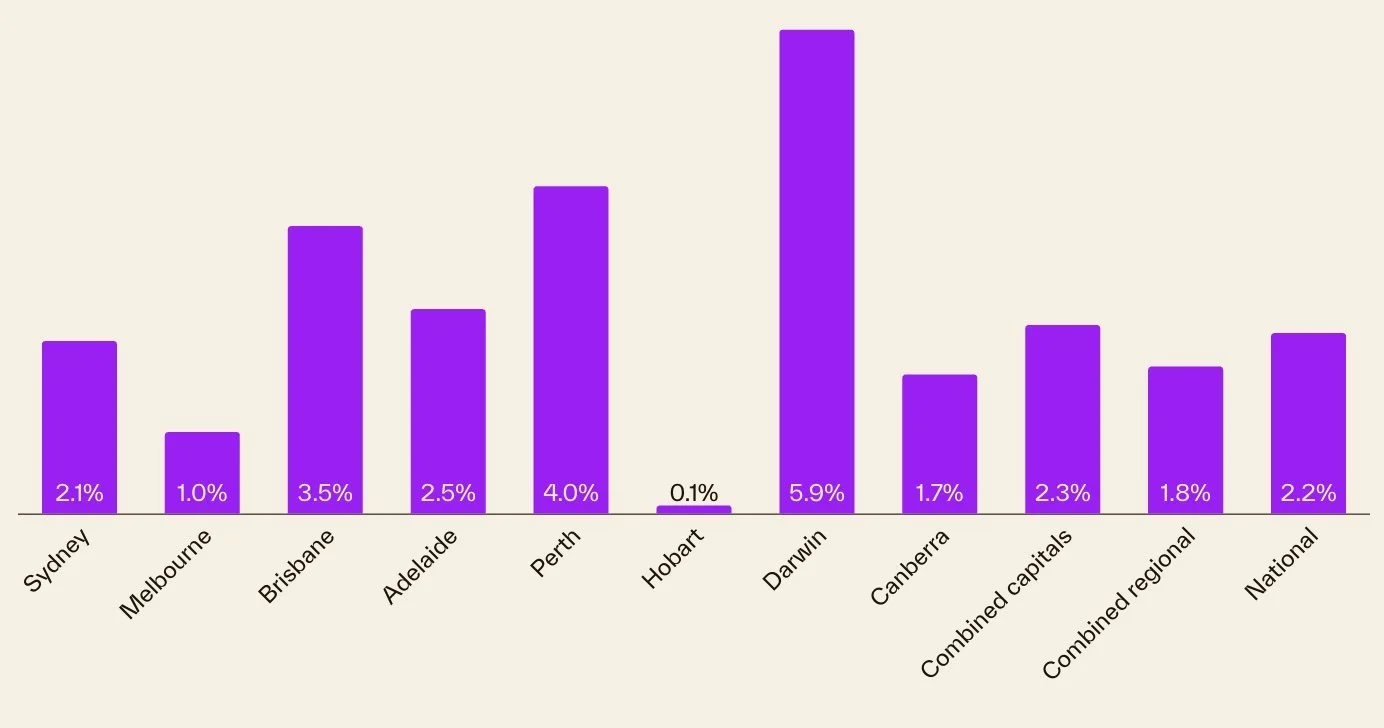

Latest pricing data from Cotality shows that growth isn't uniform across the country. While all capital cities and regions saw an increase in values, the pace of growth is diverging. Perth, Brisbane, and Darwin are currently leading the charge. Interestingly, in Brisbane, unit values are now growing faster than house values, highlighting the intense demand for more affordable housing options.

How to get a step up the property ladder:

Get to know your market. We can give you a free property and suburb report for any location in the country. Just reach out.

New 5% deposit first home buyer scheme just announced

A new scheme has just been announced by the Australian Government. The scheme lets first home buyers enter the market with just 5% deposit. Its now far easier for first home buyers to get into the property market, with the removal of some previous limits on income and places available.

Many first home buyers are ecstatic. You can buy a home with just a 5% deposit. Great idea I hear you say. This scheme will undoubtedly let more buyers into the market with enquiries up 3x. But some people are also calling this the 95% borrowing scheme. And it true - you will be borrowing more, and there are risks associated with servicing a bigger loan. So be prepared before you jump in.

How to get a step up the property ladder:

If you want to know how you can get into the market and what you can afford please reach out for a chat.

We’ll also be doing a deep dive into this and other first home buyer schemes in coming weeks, so stay tuned.

Ready to Take Your Next Step?

With the market on the move, being prepared with a strong understanding of borrowing capacity and pre-approval is key.

Whether you’re a first-time home buyer, looking to refinance, or a savvy investor building an investment portfolio, understanding your options is the first step.

Call Will on 0414 877 724 or will@ladderfs.com.au and he’ll talk you through your options, so you can move forward with confidence.